Guests

- Tyson Slocumdirector of Public Citizen’s Energy Program.

- Scott Bickfordattorney who filed the first lawsuit against BP, Transocean and Halliburton on behalf of Shane Roshto, one of the crewmen who died in the Deepwater Horizon rig explosion.

“BP is a London-based oil company with one of the worst safety records of any oil company operating in America,” says Tyson Slocum of Public Citizen. “In just the last few years, BP has paid $485 million in fines and settlements to the US government for environmental crimes, willful neglect of worker safety rules, and penalties for manipulating energy markets.” We speak with Slocum and with an attorney representing several workers who survived the blast that sank BP’s Deepwater Horizon rig. He’s also representing the wife of one of the eleven workers now presumed dead who is filing a lawsuit accusing BP of negligence. [includes rush transcript]

Transcript

AMY GOODMAN: Amidst growing concerns over what’s being described as potentially the worst environmental catastrophe in US history, a senior BP executive admitted in a closed-door congressional briefing Tuesday that the ruptured oil well in the Gulf of Mexico could be gushing as much as 60,000 barrels of oil a day. That’s more than ten times the initial estimate of the flow of 5,000 barrels a day.

The White House did not comment on BP’s hour-long briefing with Congress. But earlier Tuesday, President Obama said his administration is committed to containing the economic damages the slick is set to inflict on local residents, oyster farmers, fishermen and tourism.

PRESIDENT BARACK OBAMA: We are committed to preventing as much of the economic damage as possible by working to contain the impact of this potentially devastating spill. In addition, wherever possible, I would like to see the people most affected by the disaster employed in helping in the cleanup, and we will continue to explore every possible option to create jobs and support local economies in the Gulf, while continuing to monitor any potential effects on the national economy.

AMY GOODMAN: Meanwhile, the expanding oil slick has hit the shores of Louisiana’s Chandeleur Islands, a wildlife refuge sixty miles from New Orleans. With the slick now reportedly less than thirty miles from the Alabama and Mississippi coasts, fishermen and residents from across the Gulf Coast are bracing for the impact.

LOUIS McANESPY: I worked thirty years at my business, building my business up. I have boats, oyster reefs. I can’t even do nothing with it. I can’t even sell — I couldn’t even give my boat away right now. This industry looks like it’s shot.

DWAYNE VAHAL: The whole end of the parish pretty much depends on getting in on the water in some shape or form, you know, whether it’s oysters, crab, shrimp, charter fishing. So it could affect everybody, you know? Could cripple the parish, pretty much.

MIKE BERTHOLO: We’re going to be in bad, bad trouble. There’s nothing for us to do. I mean, Mother Nature’s going to take its course, no matter what. And I don’t think the way it’s spilling into the Gulf, I don’t see no chance of them cleaning up the mess. And it could put us out of work for two to three years, maybe, who knows, maybe longer. Because they ain’t really telling us what’s going on out there. They’re just telling you what you want to hear.

FRANCES LACROSS: It’s just like Katrina, catastrophic. That’s how it feels.

AMY GOODMAN: Tyson Slocum is the director of Public Citizen’s Energy Program. He says BP has one of the worst safety records of any oil company operating in America. He’s joining us from Washington, DC.

We welcome you to Democracy Now! Tyson Slocum, just lay out BP’s record.

TYSON SLOCUM: Sure. They have been fined over $550 million over the last several years for various infractions of federal laws, spanning workplace safety, environmental protection, and even anti-market manipulation laws. One of the worst issues with BP was a refinery explosion in Texas City, Texas, in March of 2005, that resulted in BP pleading guilty to a criminal felony violation of the Clean Air Act and paying over $150 million in fines for the explosion that resulted in the deaths of fifteen workers and serious injury to 170 other workers.

And the important issue here, as we’ve seen in multiple other instances with BP, Amy, is that the immediate investigation found hundreds of workplace violations. The company was fined. It was placed on probation, where BP was expected to address the hundreds of systemic workplace safety violations that were found. When the Obama administration reviewed whether or not BP had been in compliance with this probationary period, last year the Obama administration’s Department of Labor found that BP failed to comply with the terms of its probation and fined the company an additional $87 million.

And one of the things that we’ve seen in all of these fines, whether it’s for the oil spill a couple of years ago at Prudhoe Bay, where the Department of Justice found that BP willfully under-invested in routine maintenance that allowed the pipes to corrode that resulted in 200,000 gallons of crude oil released directly into the tundra, whether it was the Commodity Futures Trading Commission fining the company $300 million for single-handedly manipulating the entire US propane market, whether it’s the Federal Energy Regulatory Commission fining BP $21 million for its role in price gouging California electricity consumers during the California electricity crisis, whether it’s other violations of the Clean Air Act at its Indiana refinery or workplace violations at its Toledo, Ohio refinery, the fact is that this company, when it’s found to have violated the law, the times that it’s been put on probation, it has not even adhered to the terms of that probation in multiple instances.

And that raises the question of when we have habitual repeat corporate lawbreakers, we need to do more than just issue financial penalties against them. When a company like BP is earning $6 billion or more in profits every three months, issuing a fine of $20 million here, $50 million here, finding them guilty of crimes as the Department of Justice has done on two occasions in just a last couple of years, that is all just the cost of doing business for the accountants at BP. We’ve got to think about permanent sanctions against repeat criminal offenders like BP. We’ve got to start talking about denying them access to lucrative leases that the government sells to these companies. We’ve also got to think about revoking corporate charters of companies that habitually demonstrate to the American people that they don’t have respect for US laws, US worker safety or US environmental laws.

AMY GOODMAN: Tyson Slocum, the corporation Transocean that manages the deepwater oil rig that exploded?

TYSON SLOCUM: Yes, BP was leasing this rig. First, about this oil spill, BP won the rights to this lease at a Department of Interior auction in March of 2008. BP paid $34 million for the right to extract oil and gas, as much of it as they could, over a decade. And so they hired Transocean to operate the rig, that basically floats on 5,000 feet of water, that then was drilling down. Transocean operates a number of other rigs. You know, Congress and the Department of Interior are going to be conducting a full investigation to determine whether or not there was negligence by either BP, Transocean, which was a contractor that was operating the rig, or Halliburton, the oil services company that had just cemented the well just prior to the explosion. But the fact is that BP was the leaseholder. They are the ones ultimately responsible under the Oil Pollution Act of 1990. And also, BP management would have been overseeing any of the contractors, whether they be Transocean or Halliburton. So even if one of the contractors, whether Halliburton or Transocean, were found to be negligent, it is likely that BP will also be held responsible since they were in charge of managing the entire operation.

AMY GOODMAN: Tyson Slocum, we’re going to come back to this discussion after break. I also want to ask you why corporate crime that results in people’s deaths, whether we’re talking about the deaths in Texas of fifteen workers or right here in the Gulf, the eleven workers that we now presume are dead, why corporate crime is treated differently than common crime, why people aren’t going to jail for the deaths of these workers. We’re also going to be joined by an attorney for the family of one of the workers who’s died in this explosion. Tyson Slocum is director of Public Citizen’s Energy Program. We’ll be back with him and others in a minute.

[break]

AMY GOODMAN: Our guest, Tyson Slocum, director of Public Citizen’s Energy Program, he says BP has one of the worst safety records of any oil company operating in America. Joining us from Washington, DC, before we go down to Louisiana, Tyson, explain why corporate crime isn’t dealt with the same way as common crime, especially when we’re talking about the deaths of workers.

TYSON SLOCUM: Well, I think we have a very weak legal system that inadequately holds corporations accountable. And that, I think, shows the incredible power that large multinational corporations exercise over our democracy every day. Last year the Supreme Court in the Citizens United case took it to a very radical step, enshrining corporations with the rights of people under the constitutional protections of First Amendment speech rights. But the Department of Labor has a number of statutes requiring all sorts of regulations for employers to try to protect workers, but the fines and sanctions for failure to adhere to those laws and regulations are incredibly weak.

And again, when you’re dealing with a company like BP that makes billions and billions of dollars in profits every quarter, fining them $20 million here, $50 million there, just simply is a cost of doing business for the company. And so, we as a society need to think about when we are faced with a corporation like BP, that over the past couple of years has shown willful disregard for US laws and regulations — fifteen people died at a BP refinery explosion, where the company was found to have committed hundreds of violations of workplace safety laws — we have to have permanent sanctions against corporate criminals like this, whether that’s making managers and top executives criminally responsible for that misconduct or sanctioning the company by revoking its corporate charter or other types of permanent harm to the company, because, simply issuing a fine is just a slap on the wrist for a giant multinational energy corporation like BP. And if an investigation determines that this tragic oil spill and the deaths of eleven workers from the explosion on April 20th in the Gulf was due to negligence on the part of BP, we cannot tolerate just another fine and another slap on the wrist. We’ve got to take sanctions against this company.

AMY GOODMAN: Do you think the BP CEO, Tony Hayward, should go to prison?

TYSON SLOCUM: Well, I think that we need to have an investigation to determine if BP was negligent. And if it turns out that BP was negligent and that the CEO was aware of decisions that were made by top management that led to that negligence, then yes, absolutely. Executives should go to prison if they are found guilty of negligence that resulted in the deaths of workers.

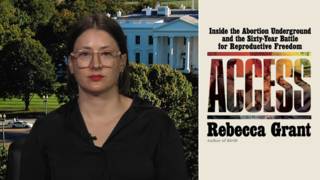

AMY GOODMAN: Well, ever since BP’s Deepwater Horizon rig exploded and sank several weeks ago, BP and Transocean have been hit by a spate of lawsuits. We’re joined now from New Orleans by an attorney representing several workers who survived the blast. As well, he is representing Natalie Roshto, the wife of one of the eleven workers who were initially missing, now presumed dead. Twenty-three-year-old Shane Roshto was a floorhand working on the drill floor when the explosions occurred. Just a day after the explosion, Scott Bickford filed the first lawsuit on behalf of Natalie Roshto against BP, Transocean and Halliburton, accusing them of negligence and violating numerous statutes and regulations. We did invite BP on the broadcast, but they declined to come on.

Scott Bickford, welcome to Democracy Now! Please explain your siut.

SCOTT BICKFORD: Good morning.

The suit that we have filed for Natalie Roshto is for the death of her husband, and it’s on behalf of her and her three-year-old son at this point. We’ve alleged BP and Transocean’s negligence, as well as allegations of Halliburton’s negligence. We’ve done further investigations to identify the drilling contractor on the rig at the time, to identify people who manufactured certain various equipment on the time, and we’ll go ahead and amend and add those parties as this suit progresses.

AMY GOODMAN: Can you tell us about Natalie Roshto and about her husband, who is now, of course, presumed dead?

SCOTT BICKFORD: They were from — they are from Liberty, Mississippi. Natalie and her three-year-old son still live there. Shane had been working as a floorhand on the rigs for about three years. He went out there to earn a very good living for his family. Rig workers make anywhere from $70,000 to $100,000 a year doing this work. They had been married just about three years. And he was a very dedicated worker. He was the guy that had his wedding date and his son’s birthdate written inside his hardhat.

AMY GOODMAN: And when was the last that Natalie heard from Shane?

SCOTT BICKFORD: Actually, the morning of the incident.

AMY GOODMAN: What did she hear?

SCOTT BICKFORD: They had just talked. It wasn’t anything about the rig or — you know, as you know, this happened around 9:30 at night. He was on the drill floor when it happened, along with ten other individuals. Those are the individuals, all of the individuals, that haven’t been found. There were people in adjacent rooms to the drill floor, where steel doors were actually blown off due to the initial explosions, and they survived. However, there have never — they have not been able to find any trace of the eleven men that were actually on the drill floor itself.

AMY GOODMAN: Had Natalie, had Shane himself, been afraid? Did Natalie see this as a dangerous job for her husband?

SCOTT BICKFORD: I think everyone sees working offshore as a dangerous job. I mean, every year there are a number of injuries and deaths from offshore workers. It’s gotten better out there from what it was when I first started practicing law some twenty-six years ago. However, you still see a number of injuries, either from helicopter crashes or from actual work on the rigs. And, you know, everyone who goes out there has a little bit of anticipation that, you know, they’re working in a dangerous environment, particularly the environment that Shane was working in, because he is doing exploratory drilling. He’s not on a production platform that’s sitting out there just producing oil out of an already-drilled well. He is on the forefront of actually going out and punching holes at 5,000 feet, which requires a tremendous amount of technology, a tremendous amount of manpower. And there are a lot of dangers in those operations.

AMY GOODMAN: Scott Bickford, you’re suing BP, Transocean and Halliburton on behalf of Shane Roshto. Explain each corporation and what you feel is their responsibility.

SCOTT BICKFORD: Well, as your prior guest stated, Transocean owns the rig. It was then leased by BP to do drilling. Halliburton is the contractor that actually cements the well. And when a well is drilled, very simply, a drill pipe is put down into the ground, and someone like Halliburton comes in and fills that pipe with cement, pushing the cement down through the pipe so it comes out of the bottom of the pipe and then gurgles up around the outside. When it gurgles up around the outside, the actual hole is cemented or cased so that the hole won’t collapse. If in fact the cementing job is done improperly for any reason, there’s the possibility that the hole collapses, there’s a possibility that the — that gases in cavities that they’re drilling through come into the pipe and come up through the pipe, and they collapse. There are some reports that part of the drilling column that they actually drilled had collapsed, and they actually had to drill a parallel column next to it, and that may have occurred because of poor cementing operations. So Halliburton’s primary job in this thing was to cement and enforce the well so it wouldn’t collapse.

Now, this well was drilled both as an exploratory well, and then this rig did something that it doesn’t normally do: it added what’s called a production liner to the well. In other words, it prepped this particular hole to actually produce, and this rig was set to move off the hole in two days and go on to another — drill another exploratory well. They would have brought another production rig over it at the time and then started producing it. But this was an exploration well, which was asked for some reason to finish production operations on this well. And there is some inference that the company itself had lost some drilling pipe in a prior well, up to $25 million worth of drilling pipe. And one of the reasons this rig stayed on this particular well to complete the production operations was to save money because they had lost money on a prior exploratory well. That, again, is something that needs to be looked into.

AMY GOODMAN: I want to follow that up with Tyson Slocum. Scott Bickford, the attorney, is in New Orleans. Tyson Slocum, with Public Citizen, is in Washington, DC. Tyson, two members of Congress, Congress member Henry Waxman and Bart Stupak, have called on Halliburton to provide all documents relating to the possibility or risk of an explosion or blowout at the Deepwater Horizon rig. They’re calling on Halliburton to do this. Can you explain further their demands? It’s by May 7th they want this information, the status of the adequacy, the quality monitoring and inspection of the cementing work.

TYSON SLOCUM: Yeah, I mean, for Halliburton, this cementing of these offshore wells is a major component of its oil services business. About 15 to 17 percent of its annual revenues come from this specific type of contracting. So they’re one of the largest contractors operating in the Gulf and around the world doing this. And I think that it’s clear that there was a problem with this particular cementing, that it did not case the well properly, and that allowed gas to escape, which caused the blowout and enveloped the rig in gas, which was then ignited and sparked the fire that killed the eleven workers. And so, I think what Congress is trying to get at here is they want to know more about Halliburton’s cementing operations. And I think we need not only Congress to look at this, but the Department of Interior needs to temporarily suspend the ability of Halliburton to continue doing this type of cementing contracting on offshore drills until we’ve got a full investigation, every step-by-step process of the way that this company operates, to ensure that they are complying with all safety regulations.

And that really brings us to another big point here, Amy, is that, you know, over the last decade, the Department of Interior, which oversees these offshore oil rigs, has not been doing a good enough job of overseeing the very powerful oil industry. We’re in an era where government regulations are being rolled back. Just in September of 2009, BP submitted comments on a proposed rule making by the Department of Interior to mandate additional safety requirements on these deepwater rigs. And BP, in those September 2009 comments, said, “We don’t need additional regulatory oversight. We have our own internal voluntary safety standards, which are adequate.” And I think, no matter what the outcome of this investigation, I think that we can all conclude here that we can no longer just trust large multinational corporations to do voluntary measures to protect the public. We have to have strong government oversight over these very, very powerful corporations.

And a decade ago, the Department of Interior, after a similar type of near blowout on an offshore oil platform, issued an emergency guidance calling for an emergency backup blowout prevention valve that would be on the sea floor in the event that you had a rig blowout, like we’ve had here in the Gulf, because we had the first tragedy, Amy, of the explosion that killed the eleven workers, and that’s probably the worst part of this whole thing, but now, the current tragedy is that oil is seeping out of the ocean floor because the rig has been destroyed, and we don’t have any mechanism so far to stop that flow of oil that is just going directly into the Gulf that is now threatening coastal ecosystems. Two countries that have extensive offshore oil drilling operations, Norway and Brazil, mandate that oil companies doing that offshore drilling have this emergency backup valve that can shut off the flow of oil in the event of a blowout. In the United States, we don’t have those requirements, and BP did not have an emergency backup system, because it was too expensive and they’re looking to cut costs. So, once again, we’ve got a situation where BP, in pursuit of bigger profits, chose not to have a demonstrated technology available that would stop the flow of oil. And now, unfortunately, a lot of people on the Gulf are paying the price.

AMY GOODMAN: Halliburton has said it’s “premature and irresponsible to speculate on any specific causal issues.” Interestingly, it was accused of performing a poor cement job in the case of a major blowout in the Timor Sea, that’s off East Timor, last August. An investigation there is underway. And as you’re talking about the standards in the United States versus other countries, Tyson Slocum, when it comes to dealing with blowout prevention?

TYSON SLOCUM: Yeah, I mean the United States has weaker standards compared to at least two other countries that have extensive offshore operations. And that’s Norway, which a lot of Americans may not realize is actually a huge oil producer and oil exporter, and Brazil, which has huge offshore oil resources. In both of those countries, they require that oil companies have to have this remote-controlled blowout valve. And so, basically, the way it works is it’s triggered acoustically. And so you’ve got a ship on the surface of the ocean that, after a blowout, could send an acoustic signal down 5,000 feet down to the sea floor, and you could have that emergency backup valve shut off that flow of oil.

These valves cost about $500,000. And, you know, BP believed that that was too expensive, and so they elected not to install that technology. But a number of experts have weighed in and said it could definitely help. Of course, Amy, there’s never a guarantee that a backup system is always going to work with a catastrophic blowout like we’ve seen. But it’s clear that in two other countries they require this because they believe it is a prudent measure to help prevent the flow of oil after a blowout. And in the United States, we currently don’t have that, and I think that Congress, one of the things that they need to do in the aftermath of this blowout is require all deepwater wells to have this technology.

And we also have to remember, Amy, that this type of drilling is a lot different than we’ve seen from a generation ago. They are drilling deeper and deeper, and that means that there’s more and more pressure, and it’s a much more dangerous activity. I mean, they’re operating in 5,000 feet of water, and the drill, from the floor of the ocean, is going another 18,000 to 20,000 feet down. These are massive operations that were not happening a decade or more ago, and we have a lot more risks. And the regulatory oversight needs to catch up to those risks, and we have to mandate that these companies comply with stronger protections both for their workers and the environment.

AMY GOODMAN: We’re also joined from San Francisco by Antonia Juhasz, the author of The Tyranny of Oil: The World’s Most Powerful Industry — And What We Must Do to Stop It. She’s director of the Chevron Program at Global Exchange. She’s been looking at the millions of dollars BP spends on lobbying.

Welcome to Democracy Now!, Antonia Juhasz. You write in The Observer that the explosion of BP/Transocean’s Deepwater Horizon drilling rig is “neither surprising nor unexpected.” Why?

ANTONIA JUHASZ: Well, for a lot of the reasons that Tyson has cited. This company, in particular, has an egregious record of cost cutting. The finding that Tyson had referenced to the 2005 Texas City explosion, the US Chemical Safety Board found basically a long history of egregious mismanagement, egregious cost cutting, and an egregious rejection to the concept of security. BP, while it was experiencing its highest profits in its own history in '99 and 2005, cut spending 25 percent across all of its US refineries. It operates five. And the Chemical Safety Board found this cost cutting and a lack of attention to security as the cause of that tragic explosion in 2005. That explosion was, at its time, the largest workplace accident in the United States in fifteen years. Now — that was fifteen workers died. Now we have eleven workers presumed dead. But certainly the magnitude of this explosion is certainly going to top that 2005 explosion, and it's the same company.

But I think, beyond the lack of surprise that — unfortunately, that the next great major US oil industry incident involved BP was the lack of surprise, unfortunately, that it took place in the US Gulf of Mexico and involved offshore drilling, and that it involved this industry. Essentially, we have the largest, wealthiest industry in the world. In 2009, for the first time, seven of the ten largest corporations on the planet were oil companies. They have used their wealth, including BP, to lobby aggressively, spend on campaigns aggressively, push the boundaries of what’s technologically feasible to get oil, and to use their money to gain access to places I think they shouldn’t even be, and to reduce the regulatory oversight over those operations. So we have them simultaneously working in places they shouldn’t be working, under less regulatory oversight than should be in place, and that has everything to do with the money available to this industry, which isn’t available to others.

AMY GOODMAN: Antonia Juhasz, talk about the lobbying money that is being spent by BP in Washington.

ANTONIA JUHASZ: BP spent $16.5 million lobbying last year. That made it among the top twenty lobbyists in the United States. That was six-and-a-half million dollars more than it spent in 2008, which was its previous record. It is following the trend of the oil industry as a whole, which has significantly increased its lobbying, essentially since the Obama administration came in, or since the Democrats took over the House and Senate.

Under the Bush administration, you essentially had an oil government, an industry that was filled with oil industry executives, lawyers, lobbyists, people on their way in and out of the administration to the oil industry. And essentially the industry was able to legislate and not lobby, which they did for eight years under Bush.

When the Democrats and Obama then took over, the industry was forced to revert to the more standard method of lobbying to get what it wants. And while this administration is most certainly not an oil administration, it is far from immune to the just massive, massive dollars that are being poured in to lobbying by this industry. And I think we evidenced that most directly when Obama continued the process that Bush began of opening up our offshore waters to more drilling. Thank goodness Obama has pulled back on that and said we’re going to wait and see to the cause of this accident. But this industry spends really enormous, unprecedented amounts of money on lobbying.

But that now may yet pale — when we look at how much, for example, BP spent on campaigns in 2008, a mere $500,000 sounds like nothing compared to its lobbying. Well, now with Citizens United, those relatively small campaign investments, relative to lobbying investments, now of course can equal the lobbying investments. And so, this is a critical moment, as Citizens United takes effect. And while we think we’ve seen the power of this industry to influence public policy, we have no idea what it’s going to be like now that they can open the floodgates. I mean, literally, this is an industry that has too much cash. It does not know what to do with its cash on hand. That’s one of the reasons why it spends $1,000,000 a day drilling for oil in places where, you know, only two out of ten of the holes they drill even yield oil. They have enough wealth to push and get as much oil as they can. Once that money starts going into campaigns, you know, we’re really at a critical juncture where we have to rein in the industry immediately before that flood of cash hits our — really hits our political spectrum.

AMY GOODMAN: Antonia Juhasz, I asked you about specifically the money that BP spends on lobbying, but overall, how much it is spending on its PR campaign, the whole rebranding of BP from British Petroleum to, what, Beyond Petroleum, its whole — what many call greenwashing?

ANTONIA JUHASZ: Yes, most certainly, greenwashing. That switch to Beyond Petroleum, I believe, took place in 2005, and it truly is simply a PR greenwash. At very best, using very generous estimates on my part, I found that BP spent, at best, four percent of its total capital and exploratory budget on anything remotely resembling green alternative energy. Now, four percent is real money when you look at BP’s budget, but it hardly qualifies the company to be Beyond Petroleum, when everything else that it’s doing is in the petroleum sector and the most aggressive modes of production, whether it’s the tar sands, offshore, you know, really breaking the boundaries of the damages that can be caused from oil production.

And that four percent, by the way, was a high point. BP has since cut its alternative energy investments significantly. It even closed its alternative energy headquarters in London. It’s really pulling itself back in, like the rest of the oil industry is, to move more aggressively into oil, the place where they can ultimately make the most money. And again, you know, oil, of course, reached a high of $150 a barrel, fell significantly down, but it’s on its way back up. So the company I pay the closest attention to, for example, Chevron, like most of the industry, its profits fell significantly last year as the price of a barrel of oil fell. Well, this first quarter of 2010, Chevron doubled its profits from the first quarter of 2009. I imagine BP is in the same circumstance. They’re on the way — they’re on their way back up, but they’re doing that by really focusing in on oil, not on alternative energy. So it is pure greenwashing to think of this company as anything other than an oil company and to think of it as anything other than a dirty oil company.

AMY GOODMAN: A 2007 customer survey found that BP, by far, had the most environmentally friendly image of any major oil company. That year, the Beyond Petroleum campaign also won the gold award from the American Marketing Association, Antonia Juhasz.

ANTONIA JUHASZ: They do a great job of marketing. They spend a lot of money on marketing. And to be fair, that public perception is right. Of all the oil companies, BP spends the most on alternative energy, or at least has over the past couple years. That four percent, sadly, was the best. Most of the other companies spent three percent, two percent, zero in the case of Exxon until very recently. So, you know, at four percent, this was the best company. That four percent is pennies. It’s pure greenwashing. The problem is that the public is increasingly perceiving this greenwashing as a real marker, a hallmark on where they think the industry is going. And it’s logical to think that if oil is running out and you’re an oil company, it makes sense that you would try and stay in business by moving into alternative energy. That just simply is not the case for any industry — or any company.

And the reason why they want us to think that they are green companies isn’t actually so that we’ll keep purchasing their gasoline. The real reason is so that we will think of them in warm and fuzzy ways and not think of them as companies that need desperately to have a heavy hand of regulation. They want to keep us from pressuring our elected officials, from saying, “We won’t vote for you, we won’t support you, we won’t do the things you need to do to stay in office, unless you take a heavy-handed regulatory approach to this industry.” If we think of them in warm, fuzzy ways and that they are about solar and wind, then we’re less likely, in all the issues that we’re all so concerned about all the time, to focus in on this industry and say it must be regulated, it is not to be trusted. And hopefully, the positive side of this horrific tragedy will be that the public will see that this is simply an industry not to be trusted. It must, instead, be regulated.

AMY GOODMAN: Finally, Tyson Slocum, the issue of President Obama’s policy that President Bush did not succeed in doing, opening the coast to offshore drilling, the announcement coming just before this explosion in the Gulf Coast, and what this means?

TYSON SLOCUM: Well, Public Citizen, along with a lot of other groups, were sharply critical last month when President Obama announced that he was going to lift the moratorium and open up new areas on the eastern United States and in the eastern Gulf of Mexico to new drilling. That was a ban that was put in place by a Republican president, Ronald Reagan. And we warned that this would have environmental consequences. And I think one result of this tragedy in the Gulf is that plans to open up new drilling on the East Coast of the United States is dead on arrival. There is no way that Republicans or Democrats, in pristine coastal areas like the Carolinas, are going to support offshore drilling when they see the devastation that’s going to be occurring and already is occurring on the Gulf.

And it really underscores the fallacy that we can “drill, baby, drill” our way to energy independence or “drill, baby, drill” our way off of foreign oil. The fact is is that this shows that domestic oil production poses significant economic harm, significant problems with the ecosystem and workplace safety, that if we really want to become energy independent and sustainable, we’ve got to get off fossil fuels, period. We just had that mining accident with Massey Energy in West Virginia, and that’s one of a series of deaths that’s occured. Our continued dependence on coal and oil presents too many harms to workers, too many harms to the climate and to our local ecosystems, and this should be a wake-up call that our dependence on these fossil fuels is just more harm than good, and we’ve got to make that transition to cleaner, renewable, sustainable energy.

AMY GOODMAN: Tyson Slocum, I want to thank you for being with us, director of Public Citizen’s Energy Program. Also, Antonia Juhasz, thank you, as well, author of The Tyranny of Oil: The World’s Most Powerful Industry — And What We Must Do to Stop It. She’s director of the Chevron Program at Global Exchange. And thank you very much to Attorney Bickford, joining us from New Orleans, who has brought suit on behalf of Shane Roshto, who died in the explosion.

Media Options