Topics

On Thursday, Juan González gave a speech at New York University on “Puerto Rico’s Debt Crisis: Economic Collapse in America’s Biggest Colony and What Can Be Done About It.”

The full video of the speech is posted below.

Transcript

ANA DOPICO: My name is Ana Dopico. I’m the director of the King Juan Carlos I of Spain Center. And it’s my pleasure and honor to welcome you here tonight for the first lecture by Juan González as the Andrés Bello chair in Latin American culture and civilization at the Center and at New York University. I want to welcome Juan and welcome his sister and his mother, who are honoring us with their presence—that’s a lot of pressure, Juan—in the first row, here tonight.

I want to agradecer for a moment the associate director of the Center, Laura Turégano, who’s right over there, who’s tremendous, and Luis Pérez, who is—was at the door and has made so many things technical, logistical possible. I want to thank my colleague Jill Lane—is Jill here somewhere?—the director of the Center for Latin American and Caribbean Studies, who’s over there, and her staff, Omar and Amalia and Bel, who have been instrumental in helping Juan feel at home. And I want to thank our colleague Arlene Davila once again for bringing Juan to all of us at NYU by nominating him for this position.

Tonight we gather to hear Juan González, the first Puerto Rican and the first Latino Andrés Bello chair, reflect on the Puerto Rican debt crisis and the political, economic and cultural contexts and forces at play in this urgent and serious geopolitical moment. Through the semester, Juan has planned a wonderful and really groundbreaking series of lectures and discussions during his tenure as Andrés Bello chair. They’ve constituted a formidable contribution, I think, to Latino studies at NYU—and I think there are people here who can confirm that—gathering urban history, Latino history, the history of social movements, journalism, commentary and public critique.

In a tremendous panel discussion on the Young Lords, he hosted Iris Morales and Miguel Meléndez and leading scholars, who told the story of the Young Lords. Two weeks ago, he led a conversation with two pioneering scholars to reflect on the history and institutional politics of Latino studies. On November 16th—and we hope you join us then—he will lead what’s really a rather unprecedented conversation at NYU, a conversation on Latino artists and their community, bringing Hamilton and In the Heights creator and actor Lin-Manuel Miranda and memoirist, writer and actress Sonia Manzano, the creator of the character who changed the face of children’s education on television for three generations by playing Maria on Sesame Street. That conversation will take place not here, because we expect an audience that’s larger than this place can hold, so it will be at Skirball Center. And you’re certainly all invited.

So it’s been a real semester of reflection and engagement with Latino history, politics and culture at the King Juan Carlos Center. Two days from now, as you can see from the extraordinary photographs on the walls of our atrium, on Friday, October 23rd, the Center will open an exhibition of six Puerto Rican photographers, a collective called Seis del Sur, called “Barrios,” that chronicles the figures, the force and vulnerability and the history of Latino communities in New York and the Caribbean. So we hope that you will return on Friday and join that opening celebration.

This semester, I want make clear, that Juan, in addition to giving these lectures and creating this enormous programming corpus, really, for our students and for our scholars, is also teaching a course on Latinos as shapers and subjects of U.S. journalism, a graduate course in the Center for Latin American and Caribbean Studies and in the journalism program. This is, of course, the theme of his last book. And he will complete his stay with us with a public lecture titled “Tribunes for the People: From Ricardo Flores Magón and Jovita Idar to Jesús Colón.” So we invite you to that, as well.

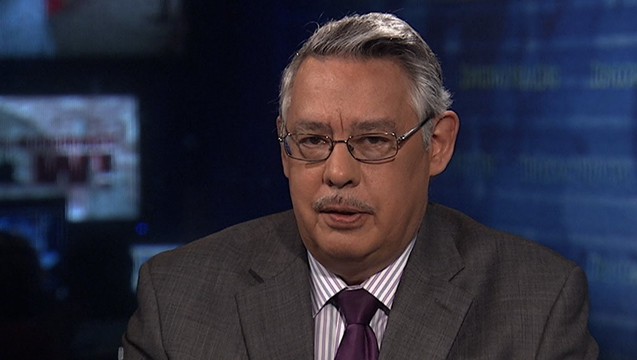

It’s my pleasure to do the honors and introduce him a little bit. For more than 35 years, Juan González has been one of the nation’s best-known Latino journalists, perhaps the best known. A staff columnist for New York’s Daily News since 1987, he’s been co-host for the past 18 years of Democracy Now!, the daily morning news show that airs on more than 1,300 public and community radio stations in the U.S. and in Latin America.

Juan has authored four books, including Harvest of Empire: A History of Latinos in America. First published 15 years ago, Harvest has become one of the most used and popular introductions to Latino history on U.S. college campuses. Probably every scholar here has used it in their classes. And the book became the subject of a documentary feature film narrated by Juan and released in 2012. Among his three other books are News for All the People: The Epic Story of Race and the American Media, Roll Down Your Window: Stories from a Forgotten America and Fallout: The Environmental Consequences of the World Trade Center Collapse. He’s currently completing a study of the new populist movements that have come to power in various American cities, something that should be of great interest to New Yorkers generally and to New York University.

Born in Ponce, Puerto Rico, Juan González was raised in East Harlem and Brooklyn, New York. He received his bachelor of arts from Columbia University. He’s been a visiting professor in public policy at Brooklyn College and now here at NYU. Even before he entered journalism, González distinguished himself as a leader of the Young Lords, minister of education for the Young Lords, a militant civil rights organization of the late 1960s, and in the National Congress for Puerto Rican Rights in the 1970s. He was one of the original founders of the National Association of Hispanic Journalists, and he served as the Association’s president from 2002 to 2004, being elected to its hall of fame in 2008. And speaking of hall of fames, two weeks ago the historic New York press organization the Deadline Club inducted Juan into their 2015 Hall of Fame, which is an extraordinary honor from a rather august organization. And joining Juan is an extraordinary cohort including Max Frankel, Lesley Stahl, Paul Steiger, Richard Stolley and Charlie Rose. But Juan is the best one. So, our congratulations.

González’s investigative reports on urban affairs, the labor movement, the environment, race relations and political troubles in Latin America have won widespread recognition, including two George Polk Awards for commentary and the 2004 Leadership Award from the National Hispanic Heritage Foundation. This deep background of investigative work will, I’m sure, be in evidence tonight alongside the deep analytical intelligence that Juan has brought to his work as a journalist, commentator and public intellectual.

I’m honored to introduce the Andrés Bello chair in Latin American culture and civilization at New York University, Juan González.

JUAN GONZÁLEZ: Thank you, and good evening to everybody. I was working on this presentation ’til the very last moment, and so some of it may be a little rough. But my thanks to Ana Dopico here at the Center, to Jill Lane at the Center for Latin American and Caribbean Studies and to New York University, for giving me the opportunity to organize public events on topics that are near and dear to my heart.

Tonight I will explore a subject that has been much in the news of late: the economic collapse and debt crisis that are currently convulsing the commonwealth of Puerto Rico. What do these twin catastrophes mean for the 3.5 million U.S. citizens who live on the island of Puerto Rico and for the general population right here in the United States? What should and can be done about it by political leaders in San Juan and Washington, given the toxic political divisions and gridlock in the government branches of both capitals? Needless to say, this is a complex topic, one that requires hard work to fully understand. I approach it as neither an expert in economics nor in political science—though you should be warned that I will subject you this evening to more charts and statistics than you might have expected.

I’ve been studying closely for more than 40 years the relationship between Puerto Rico and the United States as a journalist, as a researcher and chronicler of Latino history, as a longtime activist in the Puerto Rican communities of the United States and as someone who was born on that incredibly beautiful Caribbean island, who still has family ties there and who cares deeply about what happens to my homeland. And while I’ve written several columns this year in the Daily News and co-hosted some segments on Democracy Now! on the situation, a few hundred words in a newspaper article or a few minutes of a broadcast interview is woefully insufficient to express the magnitude of what is happening.

Don’t be misled by the one-dimensional reporting in the commercial media or even the business press. The fact is, as pointed out by several radical commentators, like Linda Backiel in Monthly Review, Ed Morales in The Nation and [Rafael] Bernabe, the former gubernatorial candidate of the small left-wing Puerto Rico workers’ party, Puerto Rico is now beset by two distinct, but closely intertwined, crises. One is fundamental stagnation of its economy, that has persisted for decades and is a direct result of its being a colony of the United States. The other is an immediate budgetary debt crisis that has been gathering steam for the past 10 years.

These two calamities have now combined to create a humanitarian catastrophe, one that is unraveling far more rapidly than most of us realize. Governor Alejandro García Padilla warned recently that his government will run out of cash by the end of November. At that point, there will be no money left in the Puerto Rican treasury to meet $354 million in debt payments that are due on December 1. This fiscal year alone, the government of Puerto Rico is staring at a $3.2 billion deficit—about 16 percent of its entire expenditures. After paying all of its operating costs, the central government projects it will have just $900 million available for $4.1 billion in debt service that comes due this year. In other words, only weeks remain to stave off a default that could reverberate throughout all of the U.S. municipal bond market.

How did this happen? The average American only became aware of this crisis in June, though Wall Street financial experts have known for years that the day of reckoning was coming. Still, corporate America was stunned when Governor García Padilla announced in a New York Times interview on June 29th and in a televised address to the people of Puerto Rico that same evening that the annual debt service on more than $72 billion in bonds that Puerto Rico and its various authorities and cities had issued over the past few decades is, quote, “no longer payable.” He thus publicly acknowledged his government was on the verge of the biggest debt default and bankruptcy in the history of American municipal bonds, far bigger than what happened in Orange County decades ago or in Detroit more recently.

By the way, you may have noticed references in some media accounts to a $72 billion debt and in others to a $73 billion debt, as if a difference of $1 billion was some minor discrepancy. Well, the actual amount of the bonds owed is $72.6 billion. So it’s up to you whether you round off the terrible news or not.

In the four months since Governor Padilla’s announcement, Puerto Rico has received more attention in the U.S. media and among Washington politicians than at any time in the island’s modern history. The almost daily coverage has surpassed even the last media juggernaut some 15 years ago, when massive civil disobedience protests forced the end of the U.S. Navy’s bombing practice on the island of Vieques. It should be noted, though, that Donald Trump’s verbal insults to Mexico and Mexican immigrants garnered far more attention from the press this summer than tiny Puerto Rico’s economic death spiral. So much for sound bites. It is tragic but almost routine these days, but it takes a crisis to get the American people to focus their gaze on the plight of 3.5 million of their fellow citizens, to stop viewing Puerto Rico simply through the same tired, stereotypical lens of either sun-drenched tourist destination or economic dependency and welfare basket case.

It is equally tragic that the various political factions on the island only seem to come together at times of extreme crisis, as they did during the Vieques movement 15 years ago. But even in the face of such a dire situation, our political leaders in Washington have done nothing about it. The Obama administration keeps talking about technical assistance to Puerto Rico, has rejected any talk of a financial bailout, and has basically done nothing to this point. Congress has even been even more cavalier, with the Republican leadership refusing to amend federal bankruptcy laws to allow Puerto Rico similar protections to restructure its debts as other states have.

We must not lose sight of a single fact, however. This crisis offers the best opportunity in decades to finally get Congress and the American people to address the question of what to do about Puerto Rico, not just in the next few months, but to resolve once and for all the issue of the island’s status. Puerto Rico is, after all, the largest overseas territory still under the sovereign control of the United States. It is the most important colonial possession in this nation’s history. I want to repeat that: Puerto Rico is the most important colony in the history of the United States.

Humane and just solutions to the current crisis will not come easily. Last week, for example, Puerto Rican leaders in the U.S. held an emergency summit in Florida to ramp up pressure on Congress and the president to provide some sort of help. Representatives Nydia Velázquez of New York and Luis Gutiérrez of Chicago spearheaded the unprecedented meeting which took place in Orlando just this past Wednesday. It included mayors, city councilmembers and state lawmakers from Connecticut, New Jersey, Massachusetts, Pennsylvania and Florida, among them, New York City Council Speaker Melissa Mark-Viverito and Bronx state Senator Gustavo Rivera and civic leaders from many states. But the organizers of that event made an unnecessary mistake by failing to fully include supporters of Puerto Rican statehood in their event and by insisting that only the immediate problems of the island’s debt be addressed, not the long-term issue of Puerto Rico’s political status.

Well, you simply cannot devise satisfactory solutions to a major economic or social problem without having a firm understanding of how that problem came to be. Of course, concrete and immediate action is what Puerto Rico needs, and no one in his or her right mind believes that the status issue will be resolved anytime soon—certainly not in the next few months, nor in the next few years, possibly not for decades more. But to ignore how colonialism has shaped the current crisis is a gross distortion of reality and damages efforts to devise any fundamental solutions.

For those of us searching for ways to assist the vast majority of those affected by this crisis—the 99 percent of Puerto Ricans as opposed to the 1 percent of the island’s elite, who are tied to the interests of American banks and multinationals—it isn’t sufficient to simply cry colonialism or to insist that nothing can be done until the status issue is resolved. Both extremes need to be discarded. We need to dig deep, to analyze how U.S. domination of Puerto Rico has evolved over the past 20 to 30 years, how changes in the world capitalist economy have been manifested in our own homeland. It is time we acknowledge that globalization has rendered historic concepts of national independence almost meaningless. You no longer need foreign armies to control the population, when you can read everyone’s mail, tap everyone’s phone, empty a country’s coffers and paralyze its economy from afar, through satellites, instant wire transfers and simple cancellations of bank credit lines. What is needed is more creative and flexible approaches to defend small nations from foreign domination, to assert national sovereignty in an increasingly interdependent world.

So tonight I hope to provide some thoughts on how the current Puerto Rican crisis reached this point and what solutions will best serve the survival and progress of the Puerto Rican masses. To do so, I will touch briefly on the following themes: the unprecedented nature of the current debt crisis; could Puerto Rico become America’s Greece; how is the crisis directly affecting the Puerto Rican people; why 117 years of colonialism is central to understanding the crisis; why Puerto Rico is a corporate gold mine, not a welfare case; how did the island’s debt mushroom out of control; who were the creditors, and who are the debtors; how should any proposed solutions be evaluated; why sustainable energy is key to Puerto Rico’s future; and the role of Puerto Ricans in the United States.

Most attention so far has centered on the total debt the central government, its various public corporations and municipal governments owe to Wall Street and bondholders. That debt has nearly doubled in the past 10 years, from about $40 billion to $72 or $73 billion. In a letter that Standard & Poor’s issued to Puerto Rico on September 10th, the rating agency lowered the island’s credit rating to CC, one of the worst ratings possible, even lower than that of Greek bonds. Standard & Poor’s noted in its letter that the Puerto Rican government now owes bondholders $13,474 for every man, woman and child on the island—equivalent to nearly 50 percent of annual gross domestic product.

But that doesn’t begin to explain the dimensions of the problem. On top of the bond debt, Puerto Rico owes another $30 billion to its main government employees’ pension fund and unfunded liabilities. As Bloomberg News reported on September 25th, the commonwealth’s Employees Retirement System, which covers 119,000 employees as of June 2014, had just 0.7 percent of the assets needed to pay all the benefits that had been promised, a level unheard of among the U.S. states—that’s Bloomberg News saying that—0.7 percent. Less than 1 percent of the money promised to future retirees is available for the Puerto Rican government.

In 2008, a previous governor, Sila Calderón, the Sila Calderón administration, issued $2.9 billion in debt just to meet its current pension payments. They were called pension bonds. The sale was underwritten by the Swiss bank UBS, produced big conflict-laden fees for UBS, whose representatives have since been found guilty of fraud and are immersed in scores of lawsuits from bondholders who were cheated. Calderón’s successor, Governor Luis Fortuño, ended up subsequently ending all defined benefit pensions for new employees of Puerto Rico. But the cash infusion the pension funds realized from that borrowing will run out in five years, at which point the government will have to come up with another $2 billion annually to pay for pensions and for the additional debt that it took out to tide it over for these current five years, and will likely have to slash benefits to retirees even more. The pension bonds—that $2.9 billion in pension bonds—are so worthless, they are now selling for about 30 cents on the dollar, for anybody who dares to buy them. Right?

Meanwhile, the Teachers Retirement System—that’s a separate retirement system—the public school teachers’ retirement system, is only about 15 percent funded. The court’s employee system is only about 14 percent funded. That represents about another $10 billion that the government owes in unfunded liabilities to those. The only—only the pension system of the university professors is in better shape. But in a messy bankruptcy battle that is sure to come, who knows what kind of pension cuts a court might impose on all the retirement systems as part of an overall settlement with the universe of debtors?

Then there is the healthcare funding crisis. In June, the federal agency in charge of Medicare and Medicaid announced that on January 1, it will slash by 11 percent its payments to 250,000 enrollees in the island’s Medicare Advantage program. Despite plans by the federal government to increase Medicare reimbursements to the 50 states by 3 percent, it’s cutting its allotment to Puerto Rico by 11 percent. The cuts will mean a loss of $300 million a year to Puerto Rico’s local government and healthcare system, a system that is already suffering because it’s been capped for decades now at only 70 percent of whatever the federal government gives per capita to other states.

The combined impact of the enormous bondholder debt, the massive unfunded pension liabilities, declining federal reimbursements for healthcare represent a perfect storm that Puerto Rico, with its shrinking economy and depression-level unemployment, cannot possibly withstand without some kind of radical restructuring of its debts in the short term and of its economy in the long term. That is why some of us have described Puerto Rico as America’s Greece. Could the island’s economic collapse and debt crisis threaten the larger economy of which it is an integral part? Most financial experts you read about dismiss the notion. But then, most discounted the possibility that the subprime mortgage crisis would spark a worldwide recession. The skeptics this time includes some prominent liberals, such as Nobel Prize-winning economist Paul Krugman, who raised the outlandish idea a few months ago that Puerto Rico was simply a victim of geography. Writing in The New York Times, Krugman said, quote, “Puerto Rico may to an important extent just suffer from being a slightly hard to reach island in a time when corporations place a high premium on easy, just-in-time shipments.”

In many ways, Puerto Rico is worse off than Greece, because it has even less ability to act independently than that depression-wracked nation. The normal refrain you hear in most media accounts is that Puerto Rico cannot resort to the normal protections of federal Chapter 9 bankruptcy because federal law only permits cities or public corporations within states to use Chapter 9, and since the island is not an independent country, it can’t go to the International Monetary Fund to seek some kind of a financial bailout the IMF is infamous for concocting. The island is in this atypical netherworld, they say. But very few go one step further and ask, “Why is that?” If it is neither a state nor an independent nation, what exactly is Puerto Rico? And why has such an important issue, like what happens when a government can’t pay its debts, fallen through the cracks when it comes to Puerto Rico? The answer is colonialism. The answer is Congress can make any laws it wants when it comes to Puerto Rico. And in the case of bankruptcy, it did just that.

First you have to understand, though, how this whole issue of municipal bankruptcy came about. During the Great Depression, cities in America started being unable to pay their debts. So in 1938, Congress passed legislation that created Chapter 9 bankruptcy. What that basically says, if you have a whole bunch that you owe money to and you can’t pay them, and they all come demanding, “Well, I have the collateral of this building or that revenue stream,” and they all want their money, you have to have an orderly restructuring. And you need a nonpartisan person, a judge, to decide how much each of the [creditors] will get and what will be the reorganization plan. And so, this was passed by Congress in 1938 to assist cities that were beset by the impact of the Great Depression.

But from 1938, when the law was passed, until 1978, Congress had included all the territories and possessions of the United States under that law, which means Puerto Rico had bankruptcy protection from 1938 to 1978. But then, between '78 and the early ’80s, there were other changes to the bankruptcy law. In 1984, there was an amendment inserted into the bankruptcy law by Senator Strom Thurmond, the infamous Strom Thurmond of South Carolina, and Bob Dole, who were both in the Senate at the time. They put in—they stuck in a little-noticed provision that specifically said Chapter 9 did not apply to Puerto Rico. No reason was given. No federal policy or interest in the change was spelled out in the amendment process. By a few simple phrases in an amendment that few people noticed, Congress laid the basis for the unique situation Puerto Rico now faces: It is not only broke, there is no established legal recourse for it to get a court to decide how the many debtors will get paid or how much. So, absent any kind of such protection, there is going to be years of litigation by different bondholders, and the government is going to have to spend millions of dollars in legal fees trying to figure it all out. And there's no—there’s no roadmap for how that will happen.

Much of this came to light when Puerto Rico tried in 2013 to create its own bankruptcy law, recognizing that it had this problem. A group of hedge funds and mutual fund managers, specifically BlueMountain Capital, Franklin Templeton and Oppenheimer, sued in U.S. district court, claiming that the federal law preempted Puerto Rico from doing that. The federal government overturned the Puerto—the federal court, the district court, overturned the Puerto Rico law earlier this year. And in July, the 1st Circuit Court of Appeals in Boston, which is the court of appeals for Puerto Rico, upheld the nullification of the Puerto Rico law.

But even one of the judges on the appeals panel, who said, “Yes, that’s the law, Puerto Rico is prohibited from doing this,” wrote a stinging opinion outlining how unfair and unjust the federal law is that prohibits Puerto Rico from using Chapter 9. That judge was Juan Torruella, who is one of the most knowledgeable jurists in the nation on the history of Puerto Rico’s status. More than 20 years ago, Torruella published one of the definitive works on the question. It’s titled The Supreme Court and Puerto Rico: The Doctrine of Separate and Unequal. I recommend it highly, if you haven’t read it.

Well, this is what Judge Torruella said in July about the case before him: “The majority’s disregard for the arbitrary and unreasonable nature of the legislation enacted in the 1984 Amendments showcases again this court’s approval of a relationship under which Puerto Rico lacks any national … representation in both Houses of Congress and is wanting of electoral rights for the offices of President and Vice-President. … This is clearly a colonial relationship, one which violates [the] Constitution.” So you have a federal appeals court judge, who’s the most knowledgeable person, saying, “Hey, this whole bankruptcy issue is another example of colonialism at work.”

Now, Senator Chuck Schumer, Representative Velázquez and other friends of Puerto Rico are trying to get Congress to allow Puerto Rico to do what it had been able to do from 1938 to 1978—have the same right as any state to use the bankruptcy laws for its municipalities. But Congress doesn’t give a damn about Puerto Rico. So Schumer is trying to do the same thing Strom Thurmond and Bob Dole did back in 1984: He’s trying to stick the provision inside some bigger bill that has to be passed, hoping that it will get through.

But the reason we’re going through this ridiculous exercise in the first place is that Congress has always decided the major decisions that affect Puerto Rico without the voice or the vote of the Puerto Rican people. And that is the essence of colonial domination. This time, though, it’s not just Washington that is facing scrutiny about its Puerto Rico policies. Wall Street is feeling the heat even more. And while the big financial experts keep assuring us that there’s no systemic threat of a messy Puerto Rico bankruptcy, we should not be so quick to believe it.

You have to understand why Puerto Rico bonds have been so popular on Wall Street. They are what is called “triple tax-exempt bonds.” “Triple tax-exempt” means that if you have the bonds, you don’t pay—your income, you don’t pay federal taxes. You also don’t pay state and local taxes. Now, most triple tax-exempt bonds are only available to the people of a particular state. So if you buy—if you live in New York and you buy New York bonds, you have triple tax exemption. If you live in California and you buy New York bonds, you don’t have triple tax exemption. You’re exempt from federal taxes, but not from state and local taxes. So, triple tax-exempt bonds produce far more return to those who buy them than other kinds of bonds. Puerto Rico’s bonds are triple tax-exempt to anyone in the United States. So anyone, whether you’re in California or Idaho, whatever, you can buy Puerto Rico bonds, and you have triple tax-exemption. It’s another example of Puerto Rico being in this netherworld of neither a state nor an independent nation.

So the very colonial relationship allows Wall Street to take advantage and reap even bigger profits, and then Puerto Rico bonds usually pay a higher interest rate, nominal interest rate. So, for instance, the last bonds that Puerto Rico floated in March of 2014 for about $2.9 billion paid an interest rate of 8 percent. That’s a nominal interest rate. Now, you get that 8 percent interest, and now you don’t have to pay any taxes to the federal government, to the state or to the city. That’s worth like 12 percent to you, right? Now, what are you getting in interest on your bank accounts these days, you know? Or even if you have a mutual—a 401(k) or a mutual fund, you’re getting an overall return of 1 or 2 or 3 percent. You know, here they were getting 12 percent, 13 percent. Of course everybody wanted to give Puerto Rico money to borrow, because they were making a killing off of the triple tax-exempt interest. That’s why there was so much willingness on the part of Wall Street to issue these bonds.

But I would offer a warning to those who poopah any possibility of economic contagion. The weak link of the entire U.S. municipal bond market is a group of obscure companies known in the business as “monoline insurers.” They are companies that promise bondholders that if a municipality or public corporation defaults on a bond, they will pay the bondholder. Such bond insurance is what provides not only triple tax exemption, but what’s called AAA ratings. Right? Those are the safest bonds, because even if a government defaults—and they rarely do—this company has promised you you’ll get all your money anyway, because they’ve insured the bonds. There’s only a few companies, about five or six companies, that offer this insurance—MBIA, Ambac. There’s several of them—Assured Guaranty.

Well, a funny thing happened the week that Governor Alejandro García Padilla made his announcement. The stock of all of these monoline insurers plummeted. Here’s the example of Assured Guaranty. You’ll notice this is June, right here. Now, the drop actually started about a week before Alejandro García made his announcement. My surmise of that is that Wall Street had the inside information already that the announcement was about to be made, and so they immediately started selling stock in all of the monoline insurers to—because they knew these monoline insurers, if Puerto Rico suddenly defaults on all this money, they don’t have the money to pay the insurance that all the bondholders will demand on them. And at that point, then the entire municipal bond market of the United States will be threatened, because there’s only a few of these companies, and all triple tax—all AAA-rated bonds will suddenly be suspect. So that’s the Achilles’ heel of the municipal bond market that’s at stake, that they don’t want to talk about too much, but you should keep your eye on as the weeks and months move ahead.

Now, what does all of this mean for the people of Puerto Rico? The island has now been in economic decline for the past 10 years, with its gross national product declining by 13 percent. And as the economy has declined, government debt to pay for basic services has increased. Puerto Ricans now pay the highest electricity rates in the United States, the highest sales tax rate in the United States. It was raised from 7 percent to 11 percent just on July 1, the sales tax. They have the highest unemployment rate in the United States.

They’re saddled with a higher cost for many consumer goods as a result of the Jones Act shipping restrictions that require all ships that bring any produce—any goods into and out of Puerto Rico must be on U.S.-constructed ships, U.S.-flagged ships and U.S.-manned ships. That alone—because the rest of the world is using Liberian and Panamanian freighters and is using Greek and Cypriot crews and has much lower labor costs, that alone costs Puerto Rico $567 million a year in extra costs for all of its goods. Now, again, this is a decision of Congress, because only a few miles away, another U.S. territory, the Virgin Islands, was exempted, waived from the Jones Act. So Congress decided to waive the Jones Act for the Virgin Islands, but not waive it for Puerto Rico. These are arbitrary decisions made by a body that does not have any responsiveness to the people that it affects.

Workforce participation rates—we heard a lot about that—are hovering at around 45 percent, as if the Puerto Rican people don’t want to work. Well, if you’ve been subjected to depression-level unemployment rates for 20, 30 years, you don’t think that’s going to have an impact on the workforce participation rate? Crime rates in Puerto Rico are among the highest in the country.

All this has predictably created massive flight from the island and population decline. Population decline. Now, Puerto Ricans are still having babies, so obviously people are fleeing. The estimates now are 50,000 a year. That’s a thousand people a week are leaving Puerto Rico. And this is going to increase as the crisis continues. The flight has led to an unparalleled housing crisis—quite the opposite of New York. The Puerto Rico Planning Board estimates that there are 1.4 million housing units on the island, of which only 861,000 have occupants. That means that one-third of all the housing in Puerto Rico is empty—is empty—because there’s been an overbuilding of housing, and then the housing economy never recovered. And the average prices, of course, of housing are plummeting, which means that the asset values of Puerto Ricans who have these houses have also been declining.

Even before this latest crisis, Governor Luis Fortuño instituted a massive austerity program. In 2009, he laid off 30,000 government workers despite a massive general strike. In 2013, he privatized Luis Muñoz Marín Airport and the Teodoro Moscoso Bridge and the toll highways. He gutted the pension system and raised the retirement age to 67. And the benefits that people now get will depend on their contributions, not on investment returns. They took—they reduced Christmas bonuses from $600 to $200. You know, they increased employee contributions to 10 percent. These are all the austerity measures that have already been taken, before this current crisis.

Ask yourself, could all of this austerity be implemented—how could all this austerity be implemented in a territory that is already the poorest in the union? Why would Congress and the American people continue to ignore a situation in Puerto Rico where depression-level unemployment has been the norm for decades?

You can’t understand why unless you grasp how colonialism had developed in Puerto Rico. Ever since the U.S. occupied and grabbed the island in 1898 during the Spanish-American War, Washington and our corporations have dictated the rules of the game for the island’s inhabitants and used Puerto Rico as a source of wealth. This was made possible by a series of U.S. Supreme Court decisions back in the 1900s that gave legal cover to the U.S. holding of a colonial empire. In one of—they’re called the “Insular” decisions. And that’s what Judge Torruella writes a lot about. One of those decisions, Downes v. Bidwell, for instance, Justice Edward White ruled that only those parts of the Constitution apply in U.S. territorial possessions that Congress chooses to apply. Puerto Rico, White concluded, belonged to but was not part of the United States. That was, in essence, the legal defense of a colonial empire, that you could have territories that belonged to you, but were not a part of your nation. Ever since the Insular Cases, all major decisions involving the island have been dependent on acts of Congress.

But don’t take my word for it. Listen to Harry Truman. I’m going to play a couple of minutes from the Harvest of Empire tape about this, the first early period—because I’ve divided the colonial development of Puerto Rico into three phases. This is my analysis; other people may do it a little differently. But there were three phases of U.S. colonial domination of the island. The first phase I will call the classic phase, where the United States sought only to extract resources, and largely sugar. And that’s where the Insular decisions came in, the Jones Act, the massive repression of the independence movement. And this is what—this is the section I’m going to play for you about this on—it’s hanging up on me a little bit.

MARTÍN ESPADA: Puerto Rico was taken as a prize of war, Spanish-American War of 1898, along with Cuba and the Philippines. Cuba and the Philippines were gradually released by the United States. Puerto Rico was not. When the United States took over Puerto Rico, so did four North American sugar companies. That’s what it was all about: sugar.

PRESIDENT HARRY TRUMAN: Puerto Rico almost blew apart because of the selfish sugar landowners. They owned tremendous tracts of land in Puerto Rico, which they devoted entirely to sugar, then worked these poor people for a dollar a day or 50 cents, if they could get them for that. And they’d rather see those people starve. I don’t mean to imply that we were in any way cruel to the Puerto Ricans, but there is another kind of cruelty. That’s indifference—indifference and neglect.

JUAN GONZÁLEZ: That was President Truman, in his own words, talking about this first classic phase of colonialism.

But then, as a result of popular uprisings, the National Party, all the labor strikes as a result of the end of World War II and the anticolonial movements in the world, the United States came up with a new policy, helped by the popular party of Puerto Rico—the industrial phase of exploitation. That depended largely on cheap labor, offshore manufacturing centers through the New Deal’s Operation Bootstrap, and corporate tax havens, known as the Section 936 benefit; deliberate mass migration of unskilled workers to the United States; a limited form of self-government and cultural autonomy by creating the Estado Libre Asociado, returning the Spanish language to the public schools, allowing Puerto Ricans to elect their own governors, but still all under the control of Congress; and a social democratic labor policy—Pan, Tierra, y Libertad—that was meant to defuse the revolutionary movements in Latin America and establish the showcase of the Caribbean. It was also marked by the building of a string of military bases as a bulwark of the Cold War.

In its early years, the dual policies of industrialization and mass immigration did improve conditions in Puerto Rico. Combined with the carrot-and-stick approach of granting limited self-government, returning the use of Spanish and overtly pro-labor policies, the commonwealth’s first social democratic governor, Luis Muñoz Marín, did co-opt and deflect much of the nationalist, independence and radical labor movements that had spread in the 1930s. And combined with the infamous Ley de La Mordaza that criminalized any independence activities, this new form of disguised colonialism ushered in limited prosperity.

But the miracle evaporated quickly. Annual growth rates dropped from an average of 6 percent during the 1950s to 4 percent in the 1970s, and they were stagnant throughout the 1980s. By then, Puerto Rico had become the most profitable entity in the world for U.S. corporations. The cheap labor model, though, started finding greener pastures in China, in Bangladesh, in Mexico, in Vietnam, as they offered even cheaper labor. And so, then, in 2006, Congress began to phase out the last federal tax loophole for island manufacturers. It actually started in 1996—and this is a fascinating story.

In 1996, Bill Clinton was trying to run for re-election. He wanted to raise the federal minimum wage. He needed the support of the Republicans in Congress, who were then led by Newt Gingrich, and they controlled the House. So, he had to cut a deal with Newt Gingrich to be able to raise the minimum wage. The deal that they cut was that Gingrich would demand $7 billion in tax credits for small businesses to make up for the fact that they would now have to increase the minimum wage. Clinton agreed. Where did the $7 billion come from? It came from the tax credits that had previously been granted to corporations in Puerto Rico under the Section 936. But they didn’t do it all at once. They phased it out over 10 years. So they started in ’96, and by 2006 the credits were phased out. And as soon as they were all phased out, the companies split. Right? All of the big—the manufacturing jobs, the pharmaceutical jobs left the island. And that has been the beginning of this new phase of colonialism in Puerto Rico, which I call the “uber colonialism phase.”

The uber colonialism phase is one marked not by resource extraction, not by cheap-labored industrialization, but by finance capital. The financial system decided, “OK, you don’t have—you structurally don’t have the money, the way this thing is set up to keep running, so we’re just going to keep lending you money.” That’s why you had the explosion of debt, and that’s why you have now the peddling of massive bonds. But, of course, when the bills come due, then the bankers say, “Well, you’re just going to have to tighten your belts, you’re just going to have to reduce spending, because you still have to pay us first. So you have to keep reducing spending.” And so, that is the phase that Puerto Rico is now in, this new phase of finance domination of its economy.

And now, we keep hearing that Puerto Rico is in bad shape, that it’s requiring all this federal money. Well, the next slide is the most important one for you to remember. It’s what’s called the gap between GNP and GDP. Right? What does that mean? You know, OK, gross domestic product is the value of all the goods produced in your country, in a particular area. That’s the gross domestic product. GNP is the value of all the goods produced in your country that stay in your country—that stay in your country. So the gap between GDP and GNP is a perfect chart of all the money that is leaving Puerto Rico in the form of profits, largely, overwhelmingly, for American corporations. And you see that even as things got worse, as even as things got worse for the Puerto Rican economy, the gap between the two kept growing. So you’re talking that in 2010, $33 billion of wealth produced by the Puerto Rican people left the island in just one year—in just one year. The total debt of the island is $72 billion, but $33 billion is being siphoned every year from Puerto Rico in the profits of the multinational corporations that comes back to the United States. So that is—that is the key to understand.

Puerto Rico has always been a gold mine; this is not—this is not something new. Between 1960 and 1976, tiny Puerto Rico catapulted from sixth to first in Latin America for total U.S. direct investment, with island workers registering some of the highest productivity levels in the world. The results were levels unheard of—of profits unheard of at home. By 1976, Puerto Rico accounted for 40 percent of all U.S. profits in Latin America, more than the combined earnings of all the U.S. subsidiaries in Brazil, Mexico and Venezuela combined. That was in 1976. By then, several multinationals were reporting a quarter of all their worldwide profits were coming from tiny Puerto Rico. From its 4,000 workers in Puerto Rico alone, Johnson & Johnson saved $1 billion in federal taxes between 1980 and 1990; SmithKlein, $987 million; Merck & Company, $749 million; Bristol-Myers Squibb, $627 million. One federal study concluded that each pharmaceutical worker in Puerto Rico produced $1.5 million in value for his or her employer in 2002. Now, they were getting paid maybe $15,000, $20,000, $30,000 back in 2002. They were producing $1.5 million in value for their employers, and all that money was going to the United States. What has actually been happening in Puerto Rico for decades is that corporate America has been raping its most valuable product—human labor.

So how did the island’s debt mushroom out of control? As I said, Wall Street was eager, with the triple tax-exempt, AAA-rated, high-interest, big returns to press for—oh, one last slide I meant to—this is a comparison of GNP and—of the gap between GDP and GNP as a percentage of your economy. Notice Puerto Rico almost—oh, here, in this one, 52 percent of all the wealth created by Puerto Rico is leaving—right, is leaving—compared to all the other countries you see. Obviously, the United States is in negative. There’s more wealth—it’s producing more GNP. But look at all the others, and look at Puerto Rico, in terms of the gap between GNP and GDP.

So, what is this $72 billion in debt? How did it come about? Well, this is a summary of some of the biggest, because there are many kinds of bonds, it’s a complicated situation, all kinds of interests. But the commonwealth owes about $13 billion in general obligation bonds. Those are bonds that were floated to run the island. They’re guaranteed not only by the government, but the constitution of Puerto Rico requires Puerto Rico to pay those bonds. It’s a constitutional issue for the island. Not the same with the others. There’s something called the COFINA bonds. Right? Because the COFINA bonds are bonds, revenue bonds, that are only paid back from sales tax revenue. So, one of the reasons the government raised sales tax from 7 to 11 is to create more money. But that first has to go to pay those bonds. The $15 billion sales tax revenue has to go to pay those bonds.

They created all kinds of other corporations that have separate revenue that then pay separate bonds. So, the other big one is PREPA. That’s the gold—that’s the Crown Jewels of Puerto Rico, is the electric company, PREPA. And it has about $8.3 billion in bonds. Then, the Government Development Bank, the Puerto Rico Highway and Transportation Authority, which has obviously toll revenue, and its toll revenue is pledged to pay off those bonds. The Aqueducts and Sewer Authority has—that’s the water, so that water is pledged, the water revenue. Everything in Puerto Rico is already pledged on certain bonds to pay those back before anything else happens. And there are the pension obligation bonds that I mentioned to you before, the $2.9 billion in pension obligation bonds. These are only some. Then there’s a bunch of municipalities have their own bonds. And there’s other—the convention center has its bonds. Everything in Puerto Rico is bonded and is owed to someone—to someone outside the country.

And here’s an example of some of the—how some of them line up. The hedge funds—because then, the other issue you’ve heard a lot about is hedge funds. What do the hedge funds have to do with it? Well, the bond—the mutual bond companies, like Oppenheimer and Franklin Templeton, they’re in your 401(k), they’re in government pensions, funds all across the country of huge companies. They’ve been buying a lot of Puerto Rico bonds for the returns. But they bought the bonds when they were at $100—in other words, at par, what they call par. So they were issued $100, and they bought them then. You saw how the pension bonds went from $100 to 32 cents on the—you know, 32 cents on the dollar. Well, as the financial situation in Puerto Rico declined, the value of the bonds dropped dramatically on Wall Street, and that’s when the hedge funds swoop in. The hedge funds swoop in, and they buy the bonds from Oppenheimer or Franklin Templeton or an individual bondholder who has them and says, “OK, these bonds are worthless. They’re selling now for 32 cents on the dollar. I’ll give you 60 cents on the dollar. You make—you know, you get some of your loss back. But then I’ll own the bonds.” And that’s what the hedge funds do. They swoop in in times of distress, grab the bonds at discounted rates, but then they want to get paid the full 100 percent. Right? So, because if they do that, or even now with PREPA, the bondholders have offered Puerto Rico a deal. They said, “OK, we won’t insist on 100 percent. We’ll take 85 percent. We’ll take 85 cents on the dollar.” Well, if you bought them at 60 cents on the dollar a couple of years ago, and now you want to sell them for 85, you’re making a killing, even when you claim you’re cutting Puerto Rico a break. So this is the issue that now—where the hedge funds swoop in, and the hedge funds become the ones that drive everything, because usually in bondholder settlements, if it’s a voluntary settlement, two-thirds or 75 percent of the bondholders have to agree. So if one big hedge fund holds out and says, “No, that’s not enough money,” they can paralyze the entire situation. That’s why you need bankruptcy protection, to prevent the vulture funds from holding the entire process of settlements up.

And so, how do progressives and all people of goodwill who are concerned about Puerto Rico’s future maneuver during the next few weeks and months? How do we figure out what needs to be done? And more importantly, what could be done, given the political gridlock in Washington and the deep party divisions in Puerto Rico?

First, there is a need to disseminate a clear narrative on the roots of the crisis in colonialism, not in Puerto Ricans being inept, lazy or seeking a handout.

Second, we should unite with all those who say that if Puerto Ricans are U.S. citizens, they must be treated in equal fashion when it comes to federal grants, Medicaid, Medicare, bankruptcy laws. And that includes ending the discriminatory requirements of the Jones Act shipping laws. And if Congress refuses to change the bankruptcy laws, we should urge the Puerto Rican government to stop paying the debt. The refusal to pay debt service is the greatest leverage Puerto Rico has. And like President Obama with his military options, it should not be discarded.

Third, we should oppose debt restructuring that seeks greater austerity, lower wages or working conditions on the island, while preserving debt payments for bondholders.

And fourth, we should support economic efforts that promote and defend Puerto Rican sovereignty. While we should never stop insisting that only a final resolution to the status question can bring a healthy economy—can make a healthy economy possible, we also should not get stuck on that this has to be resolved now, because we all know it’s not going to be resolved now.

Last thing I want to address is why sustainable energy is so important to the solution of Puerto Rico’s problems. I mentioned to you PREPA, right, the Puerto Rico electric company. The reason that Puerto Rico has such high electric bills is that almost all of its electrical capacity is funded through oil. Its generating plants are all run by oil, and all of its oil is imported. So you have the additional costs of importing oil, and you have the enormous extra costs that Puerto Ricans have to pay for that electricity.

The hedge funds, who are now trying to negotiate their separate voluntary deal with the Puerto Rican government, have a plan. If they gain control, they want to switch Puerto Rico from oil to natural gas. They want to create liquefied natural gas ports. They’re already building one in the south of Puerto Rico. And they want to then import natural gas, which still requires the importation on an annual basis of the fuel that provides your electricity, and it’s also a fossil fuel. So it does nothing to help the situation with the environment.

The leading environmentalists in Puerto Rico say that this crisis should be used as an opportunity to totally restructure the way that Puerto Ricans get electricity, through sustainable energy. There are two—there are actually two sources of sustainable energy that Puerto Rico has immense quantities of: sun and wind. The trade winds are always blowing in Puerto Rico, and the sun is almost always shining. And once you build the structure to capture solar energy and wind energy, you no longer have to pay an annual fee to bring in the product to run your electrical plant. It’s a sustainable energy. In addition—in addition to that, there is energy efficiency, which has never been done in Puerto Rico, which also produces enormous energy audits of homes, educating the population, can dramatically lower the electrical bills. So, of all the potentials, that is so obvious, the biggest potential is not to let the hedge funds and the bondholders implement their natural gas plan, and get the Puerto Rican government and the people of Puerto Rico behind sustainable energy. And not only will it help the planet, it will reduce the costs of the economy of Puerto Rico dramatically.

So, what’s the role of Puerto Ricans in the United States? And I’m going to end with this. As I said earlier, more than 50,000 are fleeing the island’s collapsing economy every year and heading to the U.S. mainland, with the bulk of them settling in Florida. But unlike migrants from other countries, they’re already U.S. citizens and eligible to vote as soon as they arrive. “We’re planning to register 200,000 more Florida Puerto Ricans in the next six months,” one labor leader who attended Wednesday’s summit told me. “Then we’ll see if they ignore us.” This is why it’s so important to mobilize the Puerto Rican diaspora, because the majority of Puerto Ricans now live in the United States, and don’t live in Puerto Rico. You know? And that’s going to continue to be the case, so that the issue is one that—I believe it’s possible to unite all Puerto Ricans to demand fair and equal treatment, because after 117 years of colonialism and after 98 years of being official U.S. citizens, most Puerto Ricans are fed up with being ignored, dismissed and forgotten by the politicians in Washington. They don’t want handouts. They want respect. They want dignity. And they want to be appreciated for the enormous contributions they’ve made to American prosperity. And this time, if they don’t get it, the entire American economy could feel the effects. And I think that one of the key issues has to be that the Puerto Rican community in this country has to start dogging the political candidates wherever they go, of both parties, to insist that they take clear stands on what they’re going to do about a crisis that’s not going away. It’s only going to get worse. And the more that action is postponed, the worse the crisis is going to become. So that’s why the Puerto Ricans in the United States have an important role to play in achieving some kind of a measured, humane and farsighted response from the elected representatives in Congress.

So, that’s the end of my presentation, and I’ll be glad to take questions afterwards. Anyone want to ask a question about—yes, right over there?

AUDIENCE MEMBER 1: Yes, Juan, can you talk a little bit about the fondos buitres in Argentina, the experience in Argentina in relationship with the experience in Puerto Rico, and even though—you know, with the differences in the relationship with the United States, but also the response of the government of Argentina since 2003 and the government of Puerto Rico? Please?

JUAN GONZÁLEZ: Well, obviously, we all know that Argentina refused to pay the debt. And everyone predicted that the economy would like—that it would fall over the cliff into hell. And that obviously has not happened, and Argentina was able to recuperate. It still had problems accessing the credit markets, and there are still ongoing battles right here in New York City over the vulture funds, again, who are refusing to accept deals. A lot of the bondholders say, “What the heck? You know, I’ve already lost all this money. Let me at least get something for it, you know, and take what they call a haircut, a reduction of what I originally expected.” But the vulture funds, no. The vulture funds feel that they’re going to hold out as long as possible, and they are going to insist to get fully paid on the bonds that they scooped up at discount prices. And that will no doubt happen in Puerto Rico.

The interesting thing about the last series of bonds, the $2.9 billion that was basically bought up by hedge funds in March of 2014, is that the hedge funds specifically said in the bond documents, not only are we first in line for any money that the Puerto Rican government has to pay these bonds, but, two, that any disputes between us will not be heard in the commonwealth of Puerto Rico courts, it will be held in the federal district court in New York City. So they specifically moved the venue of any—because they knew that there was eventually going to be a financial problem, so they specifically required, as a condition of giving this money, that Puerto Rico fight it out here in New York, as Argentina is fighting it out here in New York with the vulture funds right now, because they feel that a bankruptcy court here will be more sympathetic to the American company than it will be to the Puerto Rican government, even though in this case it’s not a foreign government. Allegedly it’s part of the United States. But the bondholders specifically put that in, you know, requiring much more expenditure of legal fees by Puerto Rico if it entered into a dispute with them.

So, it is possible to not pay your debts and live another day. Lots of people in America have not paid their debts and lived another day. And, you know, there was an old finance expert who once told me a saying that I’ll never forget. He says, “Juan, if you borrow $10,000 from a bank and you can’t pay, you’re in trouble. If you borrow $100 million from the bank and you can’t pay, the bank’s in trouble.” Right? That the refusal to pay debts is a big leverage, and it’s even bigger the more you owe. Right? Ask Donald Trump. He’s played that game lots of times in his various deals. So that you have skin in the game, you have leverage—the question is how you use it.

Back there? Yeah.

AUDIENCE MEMBER 2: Juan, I want to thank you for an incredibly just insightful and incredibly well-researched presentation. So my first question is, when are you going to write this all up, and where can we find it? I mean, I think it would really be helpful, because I’ve been to a bunch of presentations, and this is really—

JUAN GONZÁLEZ: Yeah, well, I’ve written most of it up. I have to fix up a few things that I had to adlib because I didn’t finish in time. But, I mean, I’ve got most of it in a written form. And I’ll try to see if I can put it together soon and make it available through some venue, because I think the issue is not putting something in a magazine that takes weeks or months to get out, but getting it out as soon as possible. I might—maybe I’ll talk to Amy, and we’ll post it on the Democracy Now! website or something like that to get it out to people as soon as possible.

AUDIENCE MEMBER 2: My second question is—you talked about being—Puerto Ricans being—us being treated as U.S. citizens, justly, right? And so, I’m wondering about the tension between being treated as U.S. citizens and also the colonial status. In other words, the question in terms of independence. And when does that—and I know you went to the [inaudible] presentation, in which he did not talk about the colonial question, or at least did not talk about the fight for independence. So I’m wondering about the kind of contradiction, or at least appears to me to be a contradiction, between, on one hand, negotiating the debt, being treated as—going to Congress, being treated as U.S. citizens, on the other hand, demanding independence. And not saying that, you know, it’s the U.S. corporations that were really impressed by the billions [inaudible] Puerto Rico, and U.S. corporations should be paying this debt. I mean, now, maybe that’s an idealistic—

JUAN GONZÁLEZ: Well, yeah. Yeah, well, I think there’s—again, it is a complicated question. That’s why I say that you have to judge the solutions to which solutions promote greater sovereignty for Puerto Rico and which ones don’t. That’s why the electrical is a no-brainer, right? Because that is a national solution that stays within Puerto Rico and that strengthens the independent character of the Puerto Rican nation.

Because I don’t think—anyone who’s been to Puerto Rico, who knows the reality of Puerto Rico, understands that Puerto Rico is a separate nation. Right? There’s no doubt about that. And, in fact, Puerto Rico has more of a claim to being a nation than the United States, because it has more of a common history, language and culture in a specific place than the United States does. So, in terms of a definition of what a nation is, Puerto Rico is certainly a nation.

The problem that you have, and this is—you know, this is a subject for another discussion, is how you resolve the status question long-term—is that it’s easier to get married than it is to get divorced, right? And the reality is that Puerto Rico and the United States have been in an abusive relationship for 117 years, and many Puerto Ricans have grown accustomed to that relationship. And working out—and the reality is that the United States no longer needs Puerto Rico from what it originally acquired it for. It doesn’t need it for cheap labor. It doesn’t need it for military bases. You know, it doesn’t need it to be a showcase for the Caribbean, because there are other showcases now that it’s involved in. So all the original reasons that the United States acquired Puerto Rico for are no longer valid. However, it still has it. You know?

And it hasn’t—Congress—I think one of the reasons why Congress hasn’t been able to figure out what to do or paid attention to it, because they don’t know how to handle the situation. They understand that it would require enormous amounts of expenditures to release Puerto Rico, and they spent all these years convincing so many Puerto Ricans that they are, in truth, full-blooded American citizens, and American citizenship has become the trump citizenship of the world, that lots of people want to—they keep their own country’s citizenship, but they want to have American citizenship because it allows them to go everywhere. I remember once when I was in Haiti covering the coup against President Aristide, and the United States was getting ready to invade, and somebody in the American Embassy told me that there were 25,000 Americans in Haiti that they had to protect. And I went to them and said, “What are you talking about, 25,000 Americans in Haiti? If there’s like—if there’s 200 or 300 white Americans in this whole country, that’s a lot.” They said, “No, there’s over 25,000 Haitians that lived in the United States, became American citizens and moved back to Haiti.” Because, you know, if you become an American citizen, you can take your Social Security benefit with you. If you are still a permanent resident, you’ve got to come back to the United States every six months to be able to qualify for your Social Security. So, you know, citizenship becomes a trump citizenship for—American citizenship is a trump card. And so, to get Puerto Ricans to give up the trump card that every—all these other people all around the world are trying to get, is a thankless task, I believe.

I think that what has to happen is that the United States has to recognize the sovereignty of Puerto Rico, recognize that it is a separate nation, accept its sovereignty and then develop a pact, a free association pact, which is recognized by the United Nations as a form of decolonization, where Puerto Rico has its own seat in the United Nations, has its own ability to make treaties, has its own ability to develop its duties and everything else, but that for certain questions, like national defense or monetary systems, they—both countries agree to enter into a pact and that—and that they each recognize each other’s citizenship, that Americans who come to Puerto Rico are automatically American citizens, Puerto Ricans who come to the United States are automatically American citizens. And therefore you create a working situation where the sovereignty of the island is recognized, its culture is kept, its relative independence is kept, but at the same time we recognize that the world isn’t what it was in 1950 or 1930 or the 1920s. The world has changed. And if we don’t like figure out how to maneuver in the new world in which we live, we become, I think, irrelevant to the potentials for figuring out how to change it, you know, how to move things forward. But that’s a whole other discussion, and I know there are people who will disagree with me on that. And—but, anyway, yeah, right over here?

AUDIENCE MEMBER 3: Mucho gusto, and great presentation. I’m curious. I just recently read an article about Governor Padilla, who recently surrendered his authority to the FCB. And basically, it’s the same bondholders who own the debt, who hold the debt to the United States. So he basically handed over control to them, and this will affect this governor as well as future governors of Puerto Rico. And also, with Act 20 and 22 in play until 2035, what will be the future of Puerto Rico if we stay on the same path?

JUAN GONZÁLEZ: Well, on the financial control board, I don’t think he’s actually surrendered his control. He’s offered to surrender his control. He’s offered, as a plan to restructure, if the bondholders will accept less money—and he hasn’t said how much or over what long period of time—that he’s willing to support the creation of a financial control board in Puerto Rico. The problem is, who is going to appoint the board? There’s no legal process to appoint a financial control board. Is it Congress? There’s questions as to whether Congress has the power. García Padilla wants to keep the financial control board appointed by the governor and the Senate of Puerto Rico. The bondholders—and, I’m presuming, many people in Congress—want an outside financial control board, or at least a financial control board that’s majority controlled outside the country. So, yeah, I think financial control boards are bad ideas. And they do surrender basically all of the power of the elected officials. However, depending on what happens, a financial control board of Puerto Ricans is preferable to a financial control board of outsiders. And I think that that’s going to be part of the discussion.

But right now, there is a legal question as to whether a financial control board can even be appointed and who would do it. And there would have to be some kind of a bill passed in Congress. Again, Congress can make any laws it wants to about the territories. But there would be a lot of debate and a lot of discussion over the nature of the financial—of such a financial control board, how long—you know, New York City had a financial control board for many years after the 1970s financial debacle. And, you know, so it is a solution that’s been used in the past, but it’s got lots of problems, and I would definitely not—it wouldn’t be something that I think should be supported.

Over here?

AUDIENCE MEMBER 4: Hi. Again, thank you for your presentation. I’m wondering about the interplay of the two main political parties on the island, not that they would actually have any actual power in all of this, oddly enough. But the leaders of those parties, who are they connected to in all of this, and who do they report to?

JUAN GONZÁLEZ: Well, that’s the problem, that so many of the elite in Puerto Rico, whether of the popular party or of the statehood party, have been benefiting from a lot of these financial relationships. Like, for instance, we’ve seen some reports that Kenneth McClintock, a former senator of Puerto Rico, has been one of the lobbyists for some of the hedge funds and going back and forth in Washington. Roberto Prats, who is a big financier of the Democratic Party in the United States, a friend of Hillary Clinton, has also been apparently hired as a lobbyist for a lot of these hedge funds. There were all kinds of people in Fortuño’s party who benefited from the UBS pension bond deal, that got cuts in one way or another. So, there’s corruption. There’s—wherever there’s money, a lot of money, there’s going to be corruption. And the more money, the more corruption. So you have to take it as a given that there will be corrupt players in all of these things. You just have to hope that you can identify them and out them as quickly as possible. But there are always going to be opportunists who are going to try to take advantage and make a killing when they can. But at this stage, this crisis is so deep that that is not the central—I don’t believe that’s the central question right now. The question is: What are the policies that are going to be implemented to deal with getting Puerto Rico’s economy on some kind of a sound footing?

Yeah, over here? Yeah?

AUDIENCE MEMBER 5: Thank you for this presentation, first of all, because I’ve been trying to educate myself, and I’m an art historian, so you broke it down in such a great way that explained it to even someone like me who doesn’t know anything about economics. And my question is—when you were talking about the Greek analogy, what I find frustrating is that they stop at that, and then they don’t go to the colonialism question. And I’m wondering how to change the narrative, because I have a very good friend who’s an economics—someone who writes about economics, and he wrote something, and I sent him this long email trying to summarize the history of the island and what a [bleep] show it is and how we’re a colony. And I just like—that’s not—that part of it is not getting out. So I guess I have a question for you as a journalist about that.

JUAN GONZÁLEZ: Yeah, well, I think that’s why I gave some concrete examples, like why does the Virgin Islands not subject to the Jones Act, and Puerto Rico is? I mean, what’s the logic there? That was just an arbitrary political decision. Why did Puerto Rico have the right to do bankruptcy protection from 1938 to 19—it was actually 1984, because there was a '78 amendment that was kind of nebulous—but basically, from 1938 to 1984, and suddenly, after ’84, it didn't? You know, these were arbitrary decisions made by Congress because it could, because the Supreme Court in the early 1900s said that Congress could make any laws it wanted to make when it came to the territories and the possessions of the United States. And so, I think that those concrete examples, when people cannot answer them, then you can tell them it’s because there’s been a colonial relationship and an arbitrary decision making by Congress over the lives of the people of Puerto Rico.

Back there, all the way in the back?

AUDIENCE MEMBER 6: I was just wondering about the—like the whole narrative where you constructed three phases, because I think it’s kind of consequential to how we think, not so much—well, how the crisis plays out here, like you said, like maybe the fact that you have these insurers of the hedge funds that might be the domino right here. But in Puerto Rico it seems to me that if you look at your model, the—and even your GDP and GNP gap or chart plays this out, that gap has been happening for a long time, and it’s—since the '80s, you see it's much more widened. And in terms of public debt, the way it’s—what it’s translated into is that the Puerto Rican government has been, you know, living off a credit card.

JUAN GONZÁLEZ: Right.

AUDIENCE MEMBER 6: Right? And this, way before 2006, right? So, in a certain way, the financial character of the—let’s say, financial, rather than industrial, character of the island—that is to say, they’ve been living off a credit card—that’s been going on for decades, right? And I understand how it’s become sharpened since 2006, because the tax base has shrunk since then, and so now the Puerto Rican government hasn’t been able to pay off its debts, so therefore they recur to the debtors, and then they take out more loans on the debt.

JUAN GONZÁLEZ: Right.

AUDIENCE MEMBER 6: And that increases, so the spiral, it becomes more—more acute.

JUAN GONZÁLEZ: Becomes a death spiral, a sister characteristic.

AUDIENCE MEMBER 6: Exactly. I understand that part of it. But it seems to me, if we think about what the crisis means for the island, that now there’s no more credit card on the island, and that if you imagine that a third of the island has lived off this credit card because a third of the island has lived through public employment, then what we’re talking about is a real collapse of the model, right? And I think that that could precipitate the kind of political crisis in a much shorter period of time, in relationship to questions like colonialism, than we’ve been imagining here in the presentation. But just your thoughts on that?

JUAN GONZÁLEZ: Yeah, no, I agree that depending on what happens in Puerto Rico, to what degree the cuts and austerity—like if you start completely eliminating the pensions of people, there’s going to be an—there’s going to be a revolt on the island. But revolts don’t always lead to good outcomes. You know, look at Egypt. You know, look at many of the countries that had mass uprisings in a period of time. Unless you have a clear sense of what is the root of the problem, unless you have organizations and groups of people that will lead people in a positive direction, revolts can backfire, can create even more problems. So that, yes, there’s going to be more unrest.

There’s going to be—and I think that, yes, you’re right, the island has been living off of credit cards. But there’s a difference between having a lot of debt when you have a job and having a lot of—and continuing to accumulate debts when you don’t have a job. Right? And that’s what’s happening. Now the island has lost so much employment, but it’s still—it’s still borrowing money to pay its previous debts. And there’s no—not sufficient income coming in to pay any of this stuff. So, there’s got to be a new economic structure created.

And I agree with you. When I said that, you know, it might take years or decades to resolve the status question, it could happen much more quickly. You can never predict what—you know, how a qualitative change in a society at any given time. But the reality is that there are immediate concerns over the next few weeks and months that have to be addressed, and the main thing is not to get caught up in the battle between the estadistas and the populares and the independentistas, but to somehow get everyone to agree we’ve got to do whatever we can to assist the people right now, but for those who believe in independence and national sovereignty, to really press for and support those policies that will increase sovereignty, that will go in the direction of more—of a more independent solution to Puerto Rico of its problems.

AUDIENCE MEMBER 7: So, earlier today, Juan, there was an announcement that [inaudible] circulated now from Congresswoman Velázquez and some of the folks that were meeting with the Obama Treasury Department, that there was a modest rescue package, if you can characterize it that way, agreed upon with the Treasury Department, but that, as you mentioned earlier, this would have to be approved by Congress through legislation. So, essentially, it has as much a chance as a snowball in hell. And so—

JUAN GONZÁLEZ: Especially if the president is not willing to expend capital to press for it, right?

AUDIENCE MEMBER 7: Exactly. So, basically, they announce—tomorrow morning some of the papers are going to pick it up. But my question and my reflection, Juan, is on the motion of what some people call the so-called permanent solution to the crisis, right? And while we spend time discussing the permanent solution, which is really, you know, fundamental, this crisis is having catastrophic consequences for working families, the middle class and the working poor of the island, many of whom have chosen to vote with their feet. That’s why they are in Orlando and in other parts of the Southeast. I was sharing with you how hundreds, and perhaps thousands, of the newly arrived people are living in motels in that corridor that goes from Orlando to Kissimmee.

JUAN GONZÁLEZ: Mm-hmm.

AUDIENCE MEMBER 7: And with their families, you know, so we’re talking about a humanitarian crisis. We don’t have a war like Syria, you know, with people escaping from a war-torn territory. But there is a war, in fact, going on in Puerto Rico. It’s a war on working families and the middle class. And so, they cannot expect to, you know, support permanent solutions. They are debated by people like us in the host of, you know, the academic institutions like this. So, my reflection is on something you raised earlier, which we have talked about. It appears that this will end up, if Congress fails to act, which is likely given the makeup of Congress and the congressional leadership, being a subject for the next presidential election. And this is where Puerto Ricans can in fact exercise, perhaps for the first time in history, some leverage, if they are able, as you know, to mobilize these tens of thousands of new voters being displaced from Florida, which can decide the outcome of the presidential election, which will be an interesting episode in this country’s history.

JUAN GONZÁLEZ: Well, to add to that, you know, the Center just came out with a new population study that shows that the Puerto Rican population of Florida has now surpassed 1 million. It’s nearly as much—there’s nearly as many Puerto Ricans in Florida as there are Puerto Ricans in New York state. And it is definitely the growth area for the Puerto Rican population in the United States, so that it’s going to have a major impact, as you say, if those voters are mobilized, on Florida, which is always a battleground state in every presidential election.